Gross-based withholding taxes are used by some countries instead of corporate taxes or consumption taxes to tax revenue of digital firms in connection to transactions within a jurisdiction. Many of the individual states of the United States tax the income of their residents.

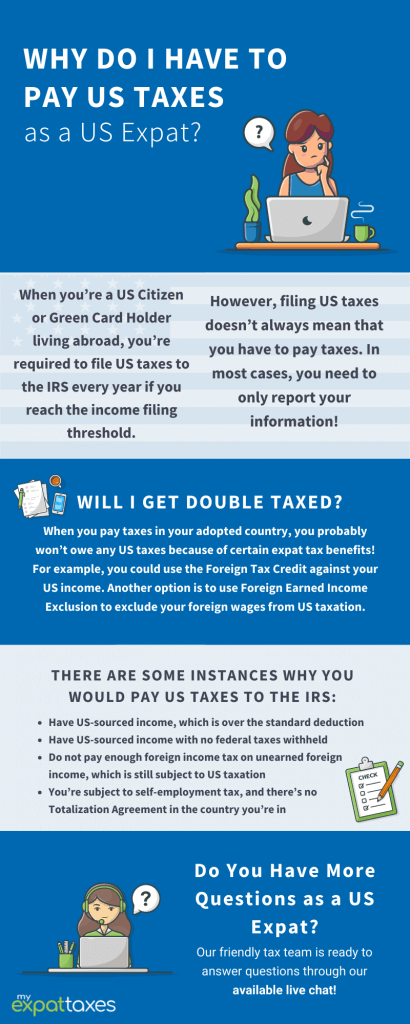

Paying Us Expat Taxes As An American Abroad Myexpattaxes

The dam will take 1 year to be.

. Also see Publication 519 US. Particulars required to be specified in the return include the amount of chargeable income and tax payable by the company. What Is Withholding Tax Example In Ethiopia.

The tax return is deemed to be a notice of assessment and is deemed served on the company upon the date the tax return is submitted. Where interest is paid or credited by any person to a non-resident or to a resident a 15 withholding tax must be deducted. The withholding tax acts as a final tax for non-residents and the rate may be reduced where the recipient is a resident of a country with which PNG has a DTA.

E-filing or online filing of tax returns via the Internet is available. Each slip is an information return and the penalty the Canada Revenue Agency CRA assesses is based on the number of information returns filed in an incorrect wayThe penalty is calculated per type of information return. Withholding reporting.

The withholding tax does not apply to interest paid to a non-resident. Malaysia has signed tax treaties with over 75 countries including most countries in the European Union the United Kingdom China Japan Hong Kong Singapore Australia. Therefore you should consult the tax.

With tax season in full swing you probably have a number of tax forms either in hand on on the way. For example if you file 51 NR4 slips and 51 T4 slips on paper the CRA would assess two penalties of 250 one for each type of information return. If youre an employee one of those forms is the form W-2 Wage and Tax StatementNo matter.

The URA has taken measures to curb VAT fraud improve compliance and plug the gaps including de-registration. Withholding tax TAX AUTHORITIES -- The body responsible for administering the tax laws of a particular country or regional or local authority. Withholding tax rates are 10 3 The 10 is in respect of the tax liabilities of the non-resident contractor while the 3 is for the tax liabilities of the employees of the non-resident contractor.

A 2 payment to. TAXATION AT SOURCE -- See. For example in the UK the CGT is currently tax year 2021-22 10 of the profit if your income is under 50000 then it is 20 if your income exceeds this limit.

Also known as Value Added Tax VAT in many other countries Goods and Services Tax GST is a consumption tax that is levied on the supply of goods and services in Singapore and the import of goods into Singapore. Gross-based withholding taxes on digital services. Tax withholding and reporting are required upon grant for restricted stock and upon vesting of RSUs.

While the manufacturer issues a sales invoice for the sale of the food products reflecting the total value of the goods the supermarket would be paying for the amount of its purchases net of the service fee. GST is an indirect tax expressed as a percentage currently 7 applied to the selling price of goods and services provided by GST registered business entities in. Argentine subsidiaries are allowed to deduct the amount reimbursed to the parent company for the cost of the benefits if a Reimbursement or Recharge Agreement is in place.

Tax treaties and some states do not. In this example both manufacturer and supermarket are assumed to be top 20000 private corporations for withholding tax purposes. After approximately 18 months of taxpayer anticipation the US Internal Revenue Service IRS has released Notice 2022-23 1 the Notice which has also been unofficially referred to as the QI rider which proposes changes to the Qualified Intermediary QI Agreement that will permit a QI to assume withholding and reporting responsibilities for.

The withholding tax rate for both services and royalties is 10 but depending on the tax treaty between Malaysia and the respective countries the rate may be further reduced. Plugging the revenue gap here comes withholding VAT. A 3 withholding tax will be levied on imports minus the cost insurance and freight.

Last modified 30 Jun 2020. Of the Ushs 5569 billion revenue shortfall projected for 201718 Ushs 475 billion was attributed to domestic VAT. TAX BASE -- Taxable base TAX BASIS -- Term used in the US to refer to an amount that represents the taxpayers investment in an asset.

There have been numerous discussions on increasing the tax revenue gap. There is an additional tax that adds 8 to the existing tax rate if the profit comes from residential property. If any property is sold with loss it is possible to offset it against annual gains.

As gross income taxes these policies do not substitute for income or consumption taxation. The CGT allowance for one tax year. Tax Guide for Aliens and Publication 515 Withholding of Tax on Nonresident Aliens and Foreign Entities.

Some states honor the provisions of US. Damit Pty Ltd an Australian company is engaged by MM Sdn Bhd to build a dam in Ulu Langat Selangor.

The Tax Cuts And Jobs Act An Appraisal In Imf Working Papers Volume 2018 Issue 185 2018

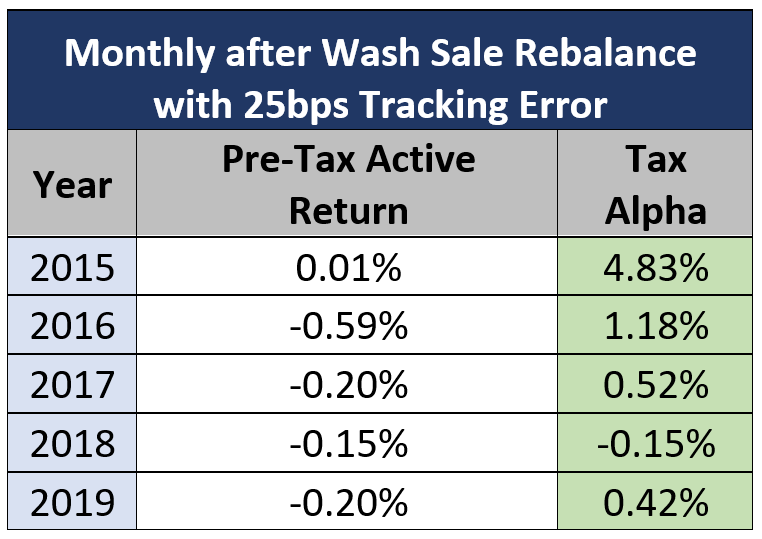

Frequently Tax Optimize Or Drift Away And Lose Tax Alpha Blog Posts Qontigo

Corporate Vs Personal Income Tax Overview

Paying Us Expat Taxes As An American Abroad Myexpattaxes

2021 Major Tax Breaks For Taxpayers Over Age 65

Mexico Global Payroll Tax Information Guide Payslip

10 8 Deferred Taxes Related To Goodwill

Demystifying Malaysian Withholding Tax Re Run Kpmg Malaysia

Income Tax Act Rewrite Tax Alerts Deloitte Australia Deloitte Papua New Guinea

What Is The Tax Treatment Of Non Fungible Tokens Are Nfts Taxable

Payroll Withholding Tax Records Xero My

Tax Policy And Inclusive Growth In Imf Working Papers Volume 2020 Issue 271 2020

Income Tax Poster Psd Template Income Tax Psd Templates Templates

The Tax Cuts And Jobs Act An Appraisal In Imf Working Papers Volume 2018 Issue 185 2018

The Tax Cuts And Jobs Act An Appraisal In Imf Working Papers Volume 2018 Issue 185 2018

What Is The Tax Treatment Of Non Fungible Tokens Are Nfts Taxable

Australian Tourism Investment Ashurst

Bbva Bank Statement Template Mbcvirtual Statement Template Bank Statement Templates